|

|

Post by Admin/YBB on May 26, 2022 4:15:09 GMT -6

AAII Sentiment Survey, 5/25/22

For the week ending on 5/25/22, the Survey became more negative: Bearish remained the top sentiment (53.5%; very high) & bullish became the bottom sentiment (19.8%; very low); neutral became the middle sentiment (26.7%, low); Bull-Bear Spread fell to -33.7% (a column is added in the table below). Investor concerns included high inflation & supply-chain disruptions; market volatility (VIX, VXN, MOVE); Russia-Ukraine war (13+ weeks). For the Survey week (Thursday-Wednesday), there were huge market movements with the results that stocks, bonds, oil, gold were all up (for a change!) but dollar declined. #AAII #Sentiment #Markets

Date Bullish Neutral Bearish Bull-Bear Spread

04-21-22 18.87% 37.26% 43.87% -25.0%

04-28-22 16.44% 24.20% 59.36% -42.9%

05-05-22 26.87% 20.26% 52.86% -26.0%

05-12-22 24.32% 26.64% 49.03% -24.7%

05-19-22 25.97% 23.64% 50.39% -24.4%

05-25-22 19.8% 26.7% 53.5% -33.7%

Observations over life of survey

Avg 37.85% 31.44% 30.71%

STD 10.06% 08.32% 09.59%

Accessible from Morningstar (M*), Mutual Fund Observer (MFO), Facebook ("at"yogibearbull), Twitter ("at"YBB_Finance).

|

|

|

|

Post by Admin/YBB on Jun 2, 2022 4:37:21 GMT -6

AAII Sentiment Survey, 6/1/22

For the week ending on 6/1/22, a huge REBOUND in Sentiment: Bearish still remained the top sentiment (37.1%) & neutral became the bottom sentiment (30.9%); bullish became the middle sentiment (32.0%); Bull-Bear Spread was only -5.1%. With all sentiments in 30s, future flip-flops are expected. Investor concerns still included high inflation & supply-chain disruptions; market volatility (VIX, VXN, MOVE); Russia-Ukraine war (14+ weeks). For the Survey week (Thursday-Wednesday), stocks were up, bonds down, oil up, gold down, dollar up. #AAII #Sentiment #Markets

Date Bullish Neutral Bearish Bull-Bear Spread

04-28-22 16.44% 24.20% 59.36% -42.9%

05-05-22 26.87% 20.26% 52.86% -26.0%

05-12-22 24.32% 26.64% 49.03% -24.7%

05-19-22 25.97% 23.64% 50.39% -24.4%

05-26-22 19.85% 26.65% 53.50% -33.6%

06-01-22 32.0% 30.9% 37.1% -5.1%

Observations over life of survey

Avg 37.84% 31.44% 30.72% +7.1%

STD 10.07% 08.32% 09.60% +17.8%

Accessible from Morningstar (M*), Mutual Fund Observer (MFO), Facebook ("at"yogibearbull), Twitter ("at"YBB_Finance).

|

|

|

|

Post by Admin/YBB on Jun 9, 2022 4:42:07 GMT -6

AAII Sentiment Survey, 6/8/22

For the week ending on 6/8/22, Sentiment reverted to very negative: Bearish remained the top sentiment (46.9%; very high) & bullish became the bottom sentiment (21.0%; very low); neutral became the middle sentiment (32.1%; above average); Bull-Bear Spread was -25.9% (low). Investor concerns included high inflation & supply-chain disruptions; the Fed (how many hikes; whether its +2% average inflation target would be moved; the FOMC meeting next week); market volatility (VIX, VXN, MOVE); Russia-Ukraine war (15+ weeks; no longer in headlines). For the Survey week (Thursday-Wednesday), stocks were up, bonds down, oil up sharply, gold up, dollar flat. #AAII #Sentiment #Markets

Date Bullish Neutral Bearish Bull-Bear Spread

05-05-22 26.87% 20.26% 52.86% -26.0%

05-12-22 24.32% 26.64% 49.03% -24.7%

05-19-22 25.97% 23.64% 50.39% -24.4%

05-26-22 19.85% 26.65% 53.50% -33.6%

06-02-22 32.02% 30.92% 37.06% -5.0%

06-08-22 21.0% 32.1% 46.9% -25.9%

Observations over life of survey

Avg 37.84% 31.44% 30.73% 7.1%

STD 10.07% 08.32% 09.60% 17.8%

Accessible from Morningstar (M*), Mutual Fund Observer (MFO), Facebook ("at"yogibearbull), Twitter ("at"YBB_Finance).

|

|

|

|

Post by Admin/YBB on Jun 16, 2022 5:09:56 GMT -6

AAII Sentiment Survey, 6/15/22

For the week ending on 6/15/22, Sentiment was extremely negative: Bearish remained the top sentiment (58.3%; very high) & bullish remained the bottom sentiment (19.4%; very low); neutral remained the middle sentiment (22.2%; near average); Bull-Bear Spread was -38.9% (very low). Investor concerns included high inflation & supply-chain disruptions; the Fed (+75 bps hike was "leaked" to WSJ on Monday; expect more 50-75 bps hikes); market volatility (VIX, VXN, MOVE); Russia-Ukraine war (16+ weeks; no longer in headlines). For the Survey week (Thursday-Wednesday), stocks, bonds, oil, gold were all down, dollar was up. #AAII #Sentiment #Markets

Date Bullish Neutral Bearish Bull-Bear Spread

05-12-22 24.32% 26.64% 49.03% -24.7%

05-19-22 25.97% 23.64% 50.39% -24.4%

05-26-22 19.85% 26.65% 53.50% -33.6%

06-02-22 32.02% 30.92% 37.06% -5.0%

06-09-22 21.02% 32.10% 46.88% -25.9%

06-15-22 19.4% 22.22% 58.3% -38.9%

Observations over life of survey

Avg 37.83% 31.44% 30.74% +7.1%

STD 10.07% 08.32% 09.60% 17.8%

Accessible from Morningstar (M*), Mutual Fund Observer (MFO), Facebook ("at"yogibearbull), Twitter ("at"YBB_Finance).

|

|

|

|

Post by Admin/YBB on Jun 23, 2022 5:35:36 GMT -6

AAII Sentiment Survey, 6/22/22

For the week ending on 6/22/22, Sentiment remained extremely negative: Bearish remained the top sentiment (59.3%; very high) & bullish remained the bottom sentiment (18.2%; very low); neutral remained the middle sentiment (22.5%; low); Bull-Bear Spread was -41.1% (very low). Investor concerns included high inflation & supply-chain disruptions; the Fed (more 50-75 bps hikes & QT); market volatility (VIX, VXN, MOVE); Russia-Ukraine war (17+ weeks). For the Survey week (Thursday-Wednesday), stocks were down, bonds up, oil down (sharply), gold up, dollar down. #AAII #Sentiment #Markets

Date Bullish Neutral Bearish Bull-Bear Spread

05-19-22 25.97% 23.64% 50.39% -24.4%

05-26-22 19.85% 26.65% 53.50% -33.6%

06-02-22 32.02% 30.92% 37.06% -5.0%

06-09-22 21.02% 32.10% 46.88% -25.9%

06-16-22 19.44% 22.22% 58.33% -38.9%

06-22-22 18.2% 22.5% 59.3% -41.1%

Observations over life of survey

Avg 37.82% 31.43% 30.75% +7.1%

STD 10.08% 08.32% 09.62% 17.9%

Accessible from Morningstar (M*), Mutual Fund Observer (MFO), Facebook ("at"yogibearbull), Twitter ("at"YBB_Finance).

|

|

|

|

Post by Admin/YBB on Jun 25, 2022 13:40:06 GMT -6

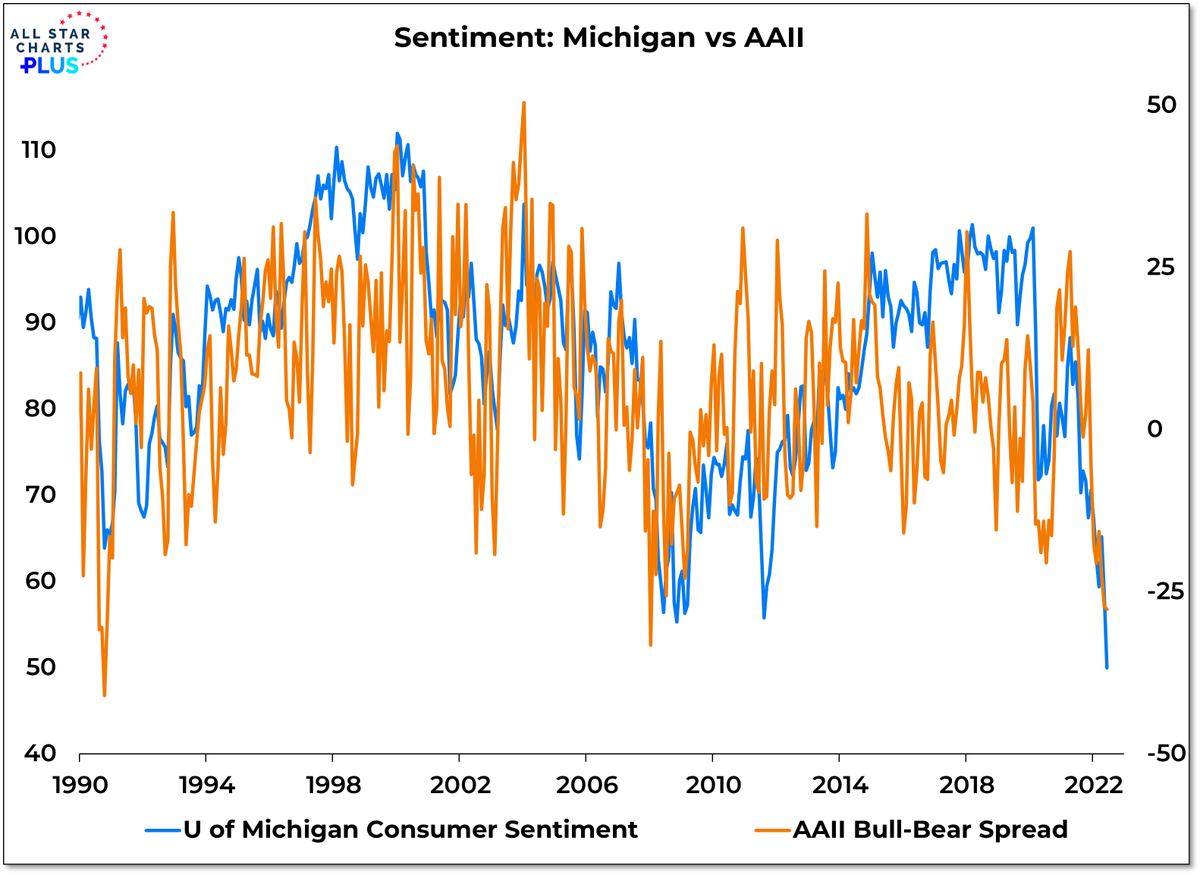

UM Sentiment and AAII Sentiment show similar patterns.  Twitter LINK Twitter LINKYBB Personal Finance (6/25/22) @ybb_Finance Replying to @williedelwiche #UMSentiment is monthly while #AAIISentiment is weekly. Would 4-week-MA or monthly samplings of AAII Sentiment data display better? Powell's reference to UM Sentiment in his 6/15/22 #FOMC press conference has suddenly caused a surge in interest in sentiment.

|

|

|

|

Post by Admin/YBB on Jun 30, 2022 5:15:55 GMT -6

AAII Sentiment Survey, 6/29/22

For the week ending on 6/29/22, Sentiment improved a bit but was very negative: Bearish remained the top sentiment (46.7%; very high) & bullish remained the bottom sentiment (22.8%; very low); neutral remained the middle sentiment (30.5%; below average); Bull-Bear Spread was -23.9% (very low; interestingly, it has good correlation with the UM Sentiment). Investor concerns included high inflation & supply-chain disruptions; the Fed; market volatility (VIX, VXN, MOVE); Russia-Ukraine war (18+ weeks). For the Survey week (Thursday-Wednesday), stocks were up, bonds up, oil up, gold down, dollar up. #AAII #Sentiment #Markets

Date Bullish Neutral Bearish Bull-Bear Spread

05-26-22 19.85% 26.65% 53.50% -33.6%

06-02-22 32.02% 30.92% 37.06% -5.0%

06-09-22 21.02% 32.10% 46.88% -25.9%

06-16-22 19.44% 22.22% 58.33% -38.9%

06-23-22 18.20% 22.46% 59.34% -41.1%

06-29-22 22.8% 30.5% 46.7% -23.9%

Observations over life of survey

Avg 37.81% 31.43% 30.77% +7.0%

STD 10.09% 08.32% 09.64% 17.9%

Accessible from Morningstar (M*), Mutual Fund Observer (MFO), Facebook ("at"yogibearbull), Twitter ("at"YBB_Finance).

|

|

|

|

Post by Admin/YBB on Jul 7, 2022 5:07:11 GMT -6

AAII Sentiment Survey, 7/6/22

For the week ending on 7/6/22, Sentiment became extremely negative again: Bearish remained the top sentiment (52.8%; very high) & bullish remained the bottom sentiment (19.4%; very low); neutral remained the middle sentiment (27.8%; below average); Bull-Bear Spread was -33.4% (very low). Investor concerns included recession; inflation & supply-chain disruptions; the Fed; market volatility (VIX, VXN, MOVE); Russia-Ukraine war (19+ weeks). For the Survey week (Thursday-Wednesday), stocks were flat-up, bonds up, oil collapsed, gold tanked, dollar up. #AAII #Sentiment #Markets

Date Bullish Neutral Bearish Bull-Bear Spread

06-02-22 32.02% 30.92% 37.06% -5.0%

06-09-22 21.02% 32.10% 46.88% -25.9%

06-16-22 19.44% 22.22% 58.33% -38.9%

06-23-22 18.20% 22.46% 59.34% -41.1%

06-30-22 22.78% 30.52% 46.70% -23.9%

07-06-22 19.4% 27.8% 52.8% -33.4%

Observations over life of survey

Avg 37.80% 31.43% 30.78% +7.0%

STD 10.09% 08.31% 09.65% 17.9%

Accessible from Morningstar (M*), Mutual Fund Observer (MFO), Facebook ("at"yogibearbull), Twitter ("at"YBB_Finance).

|

|

|

|

Post by Admin/YBB on Jul 14, 2022 4:32:20 GMT -6

AAII Sentiment Survey, 7/13/22

For the week ending on 7/13/22, Sentiment remained very negative: Bearish remained the top sentiment (46.5%; very high) & neutral became the bottom sentiment (26.6%; low); bullish became the middle sentiment (26.9%; very low); Bull-Bear Spread was -19.6% (low). Investor concerns included recession; inflation & supply-chain disruptions; the Fed/FOMC; market volatility (VIX, VXN, MOVE); Russia-Ukraine war (20+ weeks). For the Survey week (Thursday-Wednesday), stocks were down, bonds up, oil down, gold flat, dollar up. #AAII #Sentiment #Markets

Date Bullish Neutral Bearish Bull-Bear Spread

06-09-22 21.02% 32.10% 46.88% -25.9%

06-16-22 19.44% 22.22% 58.33% -38.9%

06-23-22 18.20% 22.46% 59.34% -41.1%

06-30-22 22.78% 30.52% 46.70% -23.9%

07-07-22 19.38% 27.81% 52.81% -33.4%

07-13-22 26.9% 26.6% 46.5% -19.6%

Observations over life of survey

Avg 37.79% 31.42% 30.79% +7.0%

STD 10.10% 08.31% 09.66% 17.9%

Accessible from Morningstar (M*), Mutual Fund Observer (MFO), Facebook ("at"yogibearbull), Twitter ("at"YBB_Finance).

|

|

|

|

Post by Admin/YBB on Jul 21, 2022 4:06:49 GMT -6

AAII Sentiment Survey, 7/20/22

For the week ending on 7/20/22, Sentiment remained very negative (despite improvement): Bearish remained the top sentiment (42.2%; very high) & neutral became the bottom sentiment (28.2%; below average); bullish became the middle sentiment (29.6%; low); Bull-Bear Spread was -12.6% (low; recent bottom 6/23/22). Investor concerns included recession; inflation & supply-chain disruptions (including natural gas supplies to Europe that did resume via Nord Stream 1 on Thursday Morning); the Fed/FOMC (next week); market volatility (VIX, VXN, MOVE); Russia-Ukraine war (21+ weeks); geopolitical (UK, Italy, Sri Lanka, etc). For the Survey week (Thursday-Wednesday), stocks were up sharply, bonds flat-down, oil up sharply, gold down sharply, dollar down. #AAII #Sentiment #Markets

Date Bullish Neutral Bearish Bull-Bear Spread

06-09-22 21.02% 32.10% 46.88% -25.9%

06-16-22 19.44% 22.22% 58.33% -38.9%

06-23-22 18.20% 22.46% 59.34% -41.1%

06-30-22 22.78% 30.52% 46.70% -23.9%

07-07-22 19.38% 27.81% 52.81% -33.4%

07-14-22 26.89% 26.59% 46.53% -19.6%

02-20-22 29.6% 28.2% 42.2% -12.6%

Observations over life of survey

Avg 37.78% 31.42% 30.80% +7.0%

STD 10.10% 08.31% 09.66% 17.9%

Accessible from Morningstar (M*), Mutual Fund Observer (MFO), Facebook ("at"yogibearbull), Twitter ("at"YBB_Finance).

|

|

|

|

Post by Admin/YBB on Jul 28, 2022 4:53:28 GMT -6

AAII Sentiment Survey, 7/27/22

For the week ending on 7/27/22, Sentiment continued to improve: Bearish remained the top sentiment (40.1%; high) & bullish became the bottom sentiment (27.7%; low); neutral became the middle sentiment (32.2%; near average); Bull-Bear Spread was -12.4% (low). Investor concerns included recession; inflation & supply-chain disruptions; the Fed/FOMC (rate raised +75 bps; more hikes to come; QT continues); market volatility (VIX, VXN, MOVE); Russia-Ukraine war (22+ weeks); geopolitical. For the Survey week (Thursday-Wednesday), stocks were up, bonds up, oil down, gold up, dollar down. #AAII #Sentiment #Markets

Date Bullish Neutral Bearish Bull-Bear Spread

06-23-22 18.20% 22.46% 59.34% -41.1%

06-30-22 22.78% 30.52% 46.70% -23.9%

07-07-22 19.38% 27.81% 52.81% -33.4%

07-14-22 26.89% 26.59% 46.53% -19.6%

07-21-22 29.59% 28.22% 42.19% -12.6%

07-27-22 27.7% 32.2% 40.1% -12.6%

Observations over life of survey

Avg 37.78% 31.42% 30.80% +7.0%

STD 10.10% 08.31% 09.66% 17.9%

Accessible from Morningstar (M*), Mutual Fund Observer (MFO), Facebook ("at"yogibearbull), Twitter ("at"YBB_Finance).

|

|

|

|

Post by Admin/YBB on Jul 28, 2022 16:57:06 GMT -6

|

|

|

|

Post by Admin/YBB on Aug 4, 2022 4:44:14 GMT -6

AAII Sentiment Survey, 8/3/22

For the week ending on 8/3/22, Sentiment improved significantly: Bearish remained the top sentiment (38.9%; above average) & bullish remained the bottom (tie) sentiment (30.6%; below average); neutral remained the middle (tie) sentiment (30.6%; near average); Bull-Bear Spread was -8.3% (low). With all Sentiments in 30s (last times 1/5/22, 3/23/22, 6/1/22), future flip-flops in ordering are expected. There is widening belief that the worst is behind for the Sentiment and markets; mid-June may have been the worst. Investor concerns included recession/slowdown; inflation & supply-chain disruptions; the Fed/FOMC; market volatility (VIX, VXN, MOVE); Russia-Ukraine war (23+ weeks); geopolitical. For the Survey week (Thursday-Wednesday), stocks were up sharply, bonds up, oil down sharply, gold up sharply, dollar flat. #AAII #Sentiment #Markets

Date Bullish Neutral Bearish Bull-Bear Spread

06-30-22 22.78% 30.52% 46.70% -23.9%

07-07-22 19.38% 27.81% 52.81% -33.4%

07-14-22 26.89% 26.59% 46.53% -19.6%

07-21-22 29.59% 28.22% 42.19% -12.6%

07-28-22 27.72% 32.18% 40.10% -12.4%

08-04-22 30.56% 30.56% 38.89% -08.3%

Observations over life of survey

Avg 37.77% 31.42% 30.81% +07.0%

STD 10.09% 08.30% 09.66% 17.9%

Accessible from Morningstar (M*), Mutual Fund Observer (MFO), Facebook ("at"yogibearbull), Twitter ("at"YBB_Finance).

|

|

|

|

Post by Admin/YBB on Aug 11, 2022 4:41:27 GMT -6

AAII Sentiment Survey, 8/10/22

For the week ending on 8/10/22, Bearish remained the top sentiment (36.7%; above average) & neutral became the bottom sentiment (31.2%; average); bullish became the middle sentiment (32.2%; below average); Bull-Bear Spread was -4.5% (low). With all Sentiments still in 30s, future flip-flops in ordering are expected. The strong rally from mid-June lows is at an important juncture. Investor concerns included recession/slowdown; inflation & supply-chain disruptions; the Fed/FOMC; market volatility (VIX, VXN, MOVE); Russia-Ukraine war (24+ weeks); geopolitical. For the Survey week (Thursday-Wednesday), stocks were up, bonds down/flat, oil up, gold up, dollar down. #AAII #Sentiment #Markets

Date Bullish Neutral Bearish Bull-Bear Spread

07-07-22 19.38% 27.81% 52.81% -33.4%

07-14-22 26.89% 26.59% 46.53% -19.6%

07-21-22 29.59% 28.22% 42.19% -12.6%

07-28-22 27.72% 32.18% 40.10% -12.4%

08-04-22 30.56% 30.56% 38.89% -08.3%

08-11-22 32.15% 31.19% 36.66% -04.5%

Observations over life of survey

Avg 37.77% 31.42% 30.81% +7.0%

STD 10.09% 08.30% 09.66% 17.9%

Accessible from Morningstar (M*), Mutual Fund Observer (MFO), Facebook ("at"yogibearbull), Twitter ("at"YBB_Finance).

|

|

|

|

Post by Admin/YBB on Aug 18, 2022 6:06:55 GMT -6

AAII Sentiment Survey, 8/17/22

For the week ending on 8/17/22, Bearish remained the top sentiment (36.7%; above average) & neutral remained the bottom sentiment (29.5%; below average); bullish remained the middle sentiment (33.3%; below average); Bull-Bear Spread was -3.8% (below average). The strong stock rally from mid-June lows continued. Investor concerns: Recession/slowdown; inflation; supply-chain disruptions; the Fed/FOMC; market volatility (VIX, VXN, MOVE); Russia-Ukraine war (25+ weeks); geopolitical. For the Survey week (Thursday-Wednesday), stocks were up, bonds down, oil down, gold up, dollar up. #AAII #Sentiment #Markets

Date Bullish Neutral Bearish Bull-Bear Spread

07-14-22 26.89% 26.59% 46.53% -19.6%

07-21-22 29.59% 28.22% 42.19% -12.6%

07-28-22 27.72% 32.18% 40.10% -12.4%

08-04-22 30.56% 30.56% 38.89% -08.3%

08-11-22 32.15% 31.19% 36.66% -04.5%

08-18-22 33.33% 29.51% 37.15% -03.8%

Observations over life of survey

Avg 37.76% 31.42% 30.82% +06.9%

STD 10.09% 08.30% 09.66% 17.9%

Accessible from Morningstar (M*), Mutual Fund Observer (MFO), Facebook ("at"yogibearbull), Twitter ("at"YBB_Finance).

|

|

|

|

Post by Admin/YBB on Aug 25, 2022 4:46:31 GMT -6

AAII Sentiment Survey, 8/24/22

For the week ending on 8/24/22, Bearish remained the top sentiment (42.4%; high) & bullish became the bottom sentiment (27.7%; low); neutral became the middle sentiment (29.9%; below average); Bull-Bear Spread was -14.7% (low). Investor concerns: Recession/slowdown; inflation (more fiscal stimulus); supply-chain disruptions; the Fed Conf at Jackson Hole; market volatility (VIX, VXN, MOVE); Russia-Ukraine war (26+ weeks); geopolitical. For the Survey week (Thursday-Wednesday), stocks were down sharply, bonds down, oil up sharply (OPEC put?), gold down, dollar up sharply. #AAII #Sentiment #Markets

Date Bullish Neutral Bearish Bull-Bear Spread

07-21-22 29.59% 28.22% 42.19% -12.6%

07-28-22 27.72% 32.18% 40.10% -12.4%

08-04-22 30.56% 30.56% 38.89% -8.3%

08-11-22 32.15% 31.19% 36.66% -4.5%

08-18-22 33.33% 29.51% 37.15% -3.8%

08-24-22 27.7% 29.9% 42.4% -14.7%

Observations over life of survey

Avg 37.76% 31.42% 30.82% +6.9%

STD 10.09% 08.30% 09.66% 17.9%

Accessible from Morningstar (M*), Mutual Fund Observer (MFO), Facebook ("at"yogibearbull), Twitter ("at"YBB_Finance).

|

|

|

|

Post by Admin/YBB on Sept 1, 2022 5:21:36 GMT -6

AAII Sentiment Survey, 8/31/22

For the week ending on 8/31/22, Bearish remained the top sentiment (50.4%; very high) & bullish remained the bottom sentiment (21.9%; very low); neutral remained the middle sentiment (27.7%; below average); Bull-Bear Spread was -28.5% (very low). Investor concerns: Recession; inflation; supply-chain disruptions; the Fed; market volatility (VIX, VXN, MOVE); Russia-Ukraine war (27+ weeks); geopolitical. For the Survey week (Thursday-Wednesday), stocks were down sharply, bonds down, oil down sharply, gold down, dollar flat. #AAII #Sentiment #Markets

Date Bullish Neutral Bearish Bull-Bear Spread

07-28-22 27.72% 32.18% 40.10% -12.4%

08-04-22 30.56% 30.56% 38.89% -08.3%

08-11-22 32.15% 31.19% 36.66% -04.5%

08-18-22 33.33% 29.51% 37.15% -03.8%

08-25-22 27.70% 29.92% 42.38% -14.7%

09-01-22 21.92% 27.67% 50.41% -28.5%

Observations over life of survey

Avg 37.75% 31.41% 30.84% +06.9%

STD 10.09% 08.30% 09.67% 17.9%

Accessible from Morningstar (M*), Mutual Fund Observer (MFO), Facebook ("at"yogibearbull), Twitter ("at"YBB_Finance).

|

|

|

|

Post by Admin/YBB on Sept 8, 2022 5:16:04 GMT -6

AAII Sentiment Survey, 9/7/22 For the week ending on 9/7/22, Bearish remained the top sentiment (53.3%; very high) & bullish remained the bottom sentiment (18.1%; very low); neutral remained the middle sentiment (28.7%; below average); Bull-Bear Spread was -35.2% (very low). Investor concerns: Recession; inflation; supply-chain disruptions; the Fed; market volatility (VIX, VXN, MOVE); Russia-Ukraine war (28+ weeks); geopolitical. For the Survey week (Thursday-Wednesday), stocks were mixed (in spite of a big improvement on Wednesday), bonds down, oil down sharply (again), gold flat, dollar up. #AAII #Sentiment #Markets Date Bullish Neutral Bearish Bull-Bear Spread 08-04-22 30.56% 30.56% 38.89% -8.3% 08-11-22 32.15% 31.19% 36.66% -4.5% 08-18-22 33.33% 29.51% 37.15% -3.8% 08-25-22 27.70% 29.92% 42.38% -14.7% 09-01-22 21.92% 27.67% 50.41% -28.5% 09-07-22 18.1% 28.7% 53.3% -35.2% Observations over life of survey Avg 37.75% 31.41% 30.84% +6.9% STD 10.09% 08.30% 09.67% 17.9% Bearish sentiment has been very high in 2022 ( Twitter LINK) as this bar chart of the annual average of bearish sentiment (YTD to 9/3/22) shows pbs.twimg.com/media/Fbw77yWX0AAfcjg?format=png&name=900x900 Edit/Add Edit/Add: 40-wMA of Bull-Bear Spread with 9/8/22 data, Twitter LINK2pbs.twimg.com/media/FcJU593agAAU7fE?format=png&name=medium Accessible from Morningstar (M*), Mutual Fund Observer (MFO), Facebook ("at"yogibearbull), Twitter ("at"YBB_Finance). |

|

|

|

Post by Admin/YBB on Sept 15, 2022 4:51:04 GMT -6

AAII Sentiment Survey, 9/14/22For the week ending on 9/14/22, Bearish remained the top sentiment (46.0%; very high) & bullish remained the bottom sentiment (26.1%; very low); neutral remained the middle sentiment (27.9%; below average); Bull-Bear Spread was -19.9% (very low). Investor concerns: Recession; inflation; supply-chain disruptions (a damaging RR strike averted by a last-minute deal); the Fed; market volatility (VIX, VXN, MOVE); Russia-Ukraine war (some positive developments on ground for Ukraine; Russian missile strike damaged a hydroelectric dam; 29+ weeks); geopolitical. For the Survey week (Thursday-Wednesday), stocks were down, bonds down, oil up sharply, gold down, dollar flat. #AAII #Sentiment #Markets Date Bullish Neutral Bearish Bull-Bear Spread 08-11-22 32.15% 31.19% 36.66% -4.5% 08-18-22 33.33% 29.51% 37.15% -3.8% 08-25-22 27.70% 29.92% 42.38% -14.7% 09-01-22 21.92% 27.67% 50.41% -28.5% 09-08-22 18.07% 28.66% 53.27% -35.2% 09-14-22 26.1% 27.9% 46.0% -19.9%Observations over life of survey Avg 37.74% 31.41% 30.85% +6.9% STD 10.10% 08.29% 09.68% 18.0% Edit/Add: From Bespoke LINK www.bespokepremium.com/interactive/posts/think-big-blog/sentiment-contradicts-price-actionBull-Bear History media.bespokepremium.com/uploads/2022/09/091522-AAII-3.pngWeeks of Negative Bull-Bear Spread media.bespokepremium.com/uploads/2022/09/091522-AAII-3a.pngAccessible from Morningstar (M*), Mutual Fund Observer (MFO), Facebook ("at"yogibearbull), Twitter ("at"YBB_Finance).

|

|

|

|

Post by Admin/YBB on Sept 22, 2022 5:05:45 GMT -6

AAII Sentiment Survey, 9/21/22

For the week ending on 9/21/22, Bearish remained the top sentiment (60.9%; extremely high; highest since 3/5/09) & bullish remained the bottom sentiment (17.7%; extremely low); neutral remained the middle sentiment (21.4%; low); Bull-Bear Spread was -43.2% (extremely low; lowest since 3/5/09). Investor concerns: Recession; inflation; supply-chain disruptions; the Fed (+75 hike yesterday & 100-125 bps more hikes in 2022); market volatility (VIX, VXN, MOVE); Russia-Ukraine war (partial mobilizations in Russia; 30+ weeks); geopolitical. For the Survey week (Thursday-Wednesday), stocks were down sharply, bonds down, oil down sharply, gold down, dollar up. #AAII #Sentiment #Markets

Date Bullish Neutral Bearish Bull-Bear Spread

08-18-22 33.33% 29.51% 37.15% -3.8%

08-25-22 27.70% 29.92% 42.38% -14.7%

09-01-22 21.92% 27.67% 50.41% -28.5%

09-08-22 18.07% 28.66% 53.27% -35.2%

09-15-22 26.13% 27.87% 45.99% -19.9%

09-21-22 17.7% 21.4% 60.9% -43.2%

Observations over life of survey

Avg 37.73% 31.41% 30.86% +6.9%

STD 10.10% 08.29% 09.68% 18.0%

Accessible from Morningstar (M*), Mutual Fund Observer (MFO), Facebook ("at"yogibearbull), Twitter ("at"YBB_Finance).

|

|