Post by Admin/YBB on Jan 11, 2023 14:46:59 GMT -6

FHFA & FHLBanks

There is an important support system for the US financial institutions active in housing and community development. Although not insurance, this support system has a significant role in protecting the US financial institutions.

FHFA - Federal Housing Finance Agency

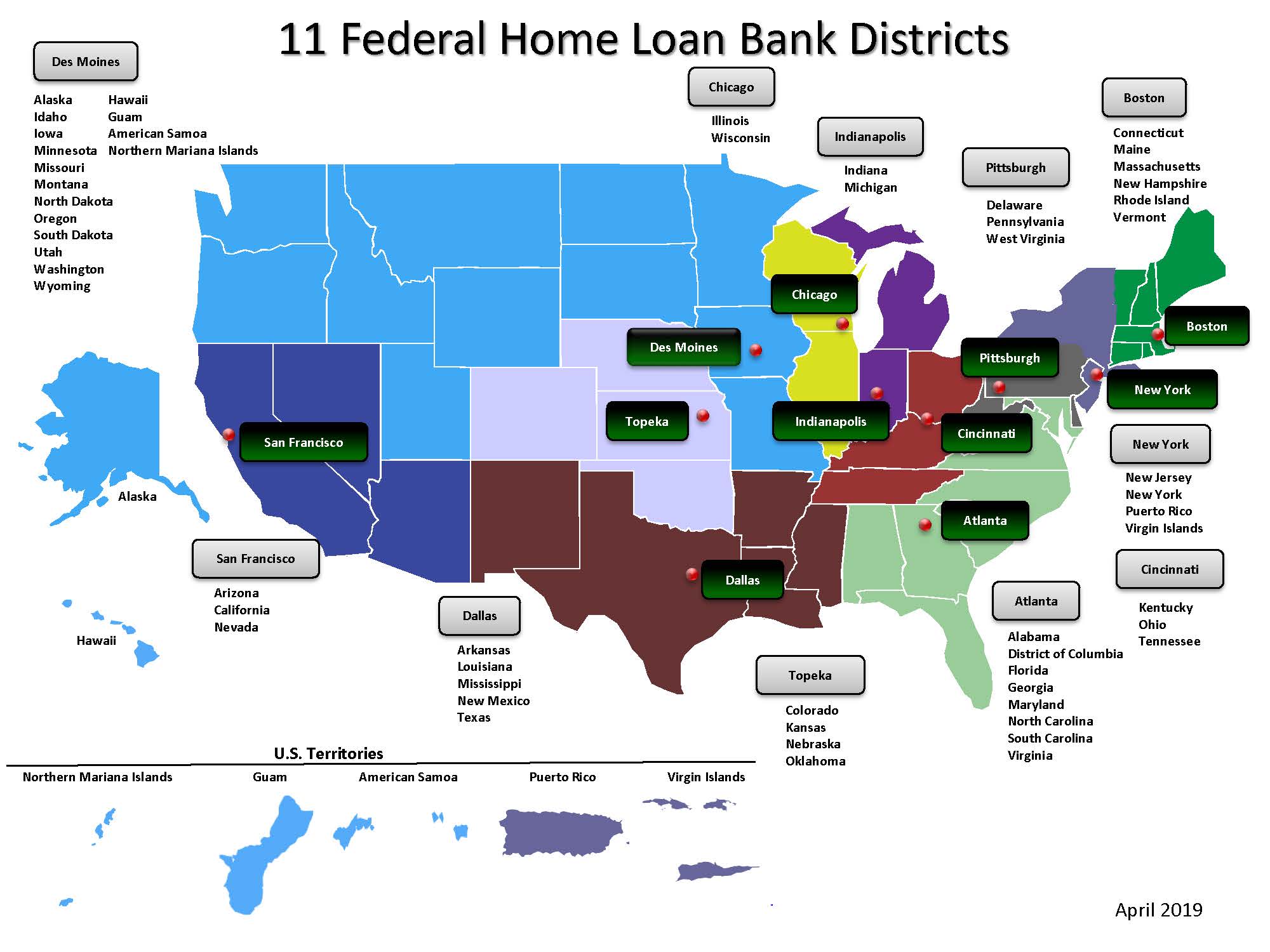

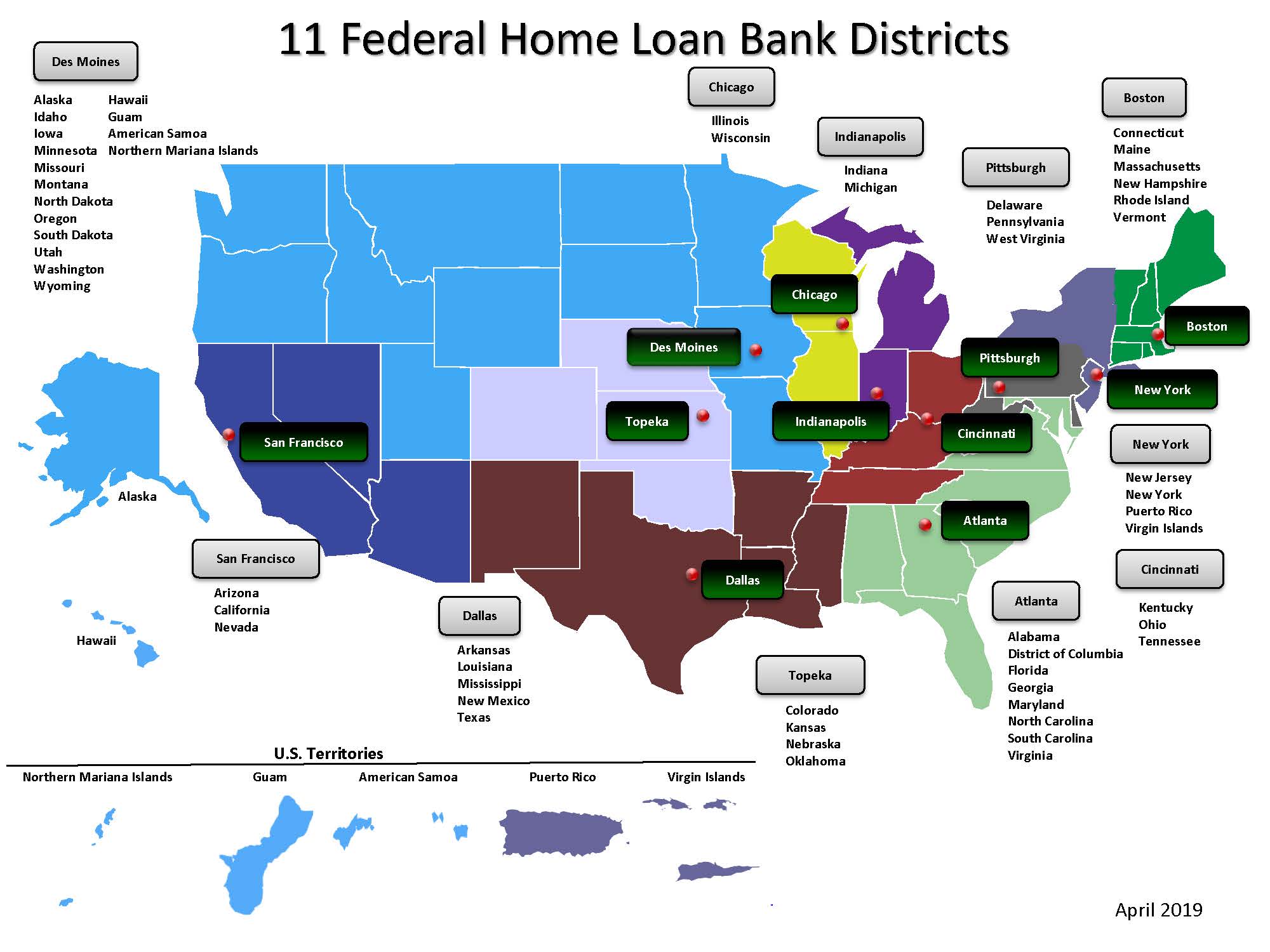

In 2008, several housing finance and regulatory agencies were consolidated under the FHFA. It currently has oversights over Fannie Mae (a GSE), Freddie Mac (a GSE), the FHLBanks (11 districts; also GSEs), etc. The FHFA is a member agency of the Financial Stability Oversight Council (FSOC; Chair, the US Treasury Secretary).

FHFB provides funding to banks, credit unions (CUs), insurance companies, CDFIs to support housing and community development. The funding is secured by overcollateralization by mortgages, Treasuries, Agencies and other acceptable assets.

FHLB - Federal Home Loan Banks

FHLB system was created in 1932 to support the US lending institutions (banks, credit unions, insurance companies, community development organizations). There are 11 district FHLBanks; each is privately and cooperatively owned and governed by its member institutions. Although not guaranteed or insured by the US Government, the FHLBanks are GSEs and have the related benefits and privileges, and are now supervised by the FHFA, a federal agency. They are tax exempt (federal, state, local) but do pay local property taxes. Their financial reports are filed with the SEC.

Their funding (advances, loans) is secured by overcollateralization through mortgages, Treasuries, Agencies and other assets. They can demand/call for additional or alternate or substitute collateral if the existing collateral becomes unsatisfactory. They have priority in claims over any other party. So, the FHLBanks had never had any losses on their advances or loans.

The obligations of each FHLB are jointly the obligations of the entire FHLB system (i.e. consolidated obligations, COs).

FHFA, Wiki en.wikipedia.org/wiki/Federal_Housing_Finance_Agency

FHFA Website www.fhfa.gov/

FHLB, Wiki en.wikipedia.org/wiki/Federal_Home_Loan_Banks

FHLB Website fhlbanks.com/

FHLBank Districts (11), image www.fhfa.gov/SupervisionRegulation/FederalHomeLoanBanks/PublishingImages/Pages/About-FHL-Banks/FHLB_map-with-territories.jpg

FHLBank Leadership fhlbanks.com/governance-and-regulation/

FHLBank Lending & Collateral, Q&A www.fhlb-of.com/ofweb_userWeb/resources/lendingqanda.pdf

FSOC, Wiki en.wikipedia.org/wiki/Financial_Stability_Oversight_Council

FSOC Website home.treasury.gov/policy-issues/financial-markets-financial-institutions-and-fiscal-service/fsoc

There is an important support system for the US financial institutions active in housing and community development. Although not insurance, this support system has a significant role in protecting the US financial institutions.

FHFA - Federal Housing Finance Agency

In 2008, several housing finance and regulatory agencies were consolidated under the FHFA. It currently has oversights over Fannie Mae (a GSE), Freddie Mac (a GSE), the FHLBanks (11 districts; also GSEs), etc. The FHFA is a member agency of the Financial Stability Oversight Council (FSOC; Chair, the US Treasury Secretary).

FHFB provides funding to banks, credit unions (CUs), insurance companies, CDFIs to support housing and community development. The funding is secured by overcollateralization by mortgages, Treasuries, Agencies and other acceptable assets.

FHLB - Federal Home Loan Banks

FHLB system was created in 1932 to support the US lending institutions (banks, credit unions, insurance companies, community development organizations). There are 11 district FHLBanks; each is privately and cooperatively owned and governed by its member institutions. Although not guaranteed or insured by the US Government, the FHLBanks are GSEs and have the related benefits and privileges, and are now supervised by the FHFA, a federal agency. They are tax exempt (federal, state, local) but do pay local property taxes. Their financial reports are filed with the SEC.

Their funding (advances, loans) is secured by overcollateralization through mortgages, Treasuries, Agencies and other assets. They can demand/call for additional or alternate or substitute collateral if the existing collateral becomes unsatisfactory. They have priority in claims over any other party. So, the FHLBanks had never had any losses on their advances or loans.

The obligations of each FHLB are jointly the obligations of the entire FHLB system (i.e. consolidated obligations, COs).

FHFA, Wiki en.wikipedia.org/wiki/Federal_Housing_Finance_Agency

FHFA Website www.fhfa.gov/

FHLB, Wiki en.wikipedia.org/wiki/Federal_Home_Loan_Banks

FHLB Website fhlbanks.com/

FHLBank Districts (11), image www.fhfa.gov/SupervisionRegulation/FederalHomeLoanBanks/PublishingImages/Pages/About-FHL-Banks/FHLB_map-with-territories.jpg

FHLBank Leadership fhlbanks.com/governance-and-regulation/

FHLBank Lending & Collateral, Q&A www.fhlb-of.com/ofweb_userWeb/resources/lendingqanda.pdf

FSOC, Wiki en.wikipedia.org/wiki/Financial_Stability_Oversight_Council

FSOC Website home.treasury.gov/policy-issues/financial-markets-financial-institutions-and-fiscal-service/fsoc